Workers to get £29k pensions boost due to Labour’s new retirement rules

SAVERS could get a boost of up to £29,000 in their pension pots by retirement thanks to Government reforms, new figures reveal.

The Government is pushing through major pension reforms in the Pension Schemes Bill which are aimed at boosting workers’ retirement pots and encouraging growth.

The Department for Work and Pensions (DWP) has now estimated a worker on an average salary who saves into their pension pot throughout their career could see an average boost of up to £29,000.

A man at the start of their career on an average salary of just over £37,000 a year would have an extra £31,000 by the time they retire.

A woman on the average salary of just under £32,000 would have £26,000 more in their pot.

The Government says the extra earnings are because the reforms will address pension underperformance, increase diversification, reduce costs being passed on to savers, and allow people to invest for longer.

The Pensions Scheme Bill has its second reading in the Commons today.

As part of the reforms, small pension pots worth £1,000 or less will be brought together into one pension scheme.

Currently many savers struggle to keep track of multiple small pension pots after moving jobs and they can end up paying high fees as a result.

The process of bringing together pension pots is called consolidation.

Another measure in the bill is a plan to move billions of pounds of pension savings into larger “megafunds”.

As part of the plans, the Government will consolidate defined contribution schemes.

Defined contribution pension schemes are a type of private pension you contribute to on a regular basis.

There are currently about 60 different multi-employer schemes, which invest pension savers’ money into funds.

But the Government says that moving pension savings into bigger “megafunds” will mean they can be invested in assets that have higher growth potential.

In turn that could mean pension savers have more in their pots by the time they retire.

The DWP previously estimated this measure alone would boost the average person’s pension pot by £6,000.

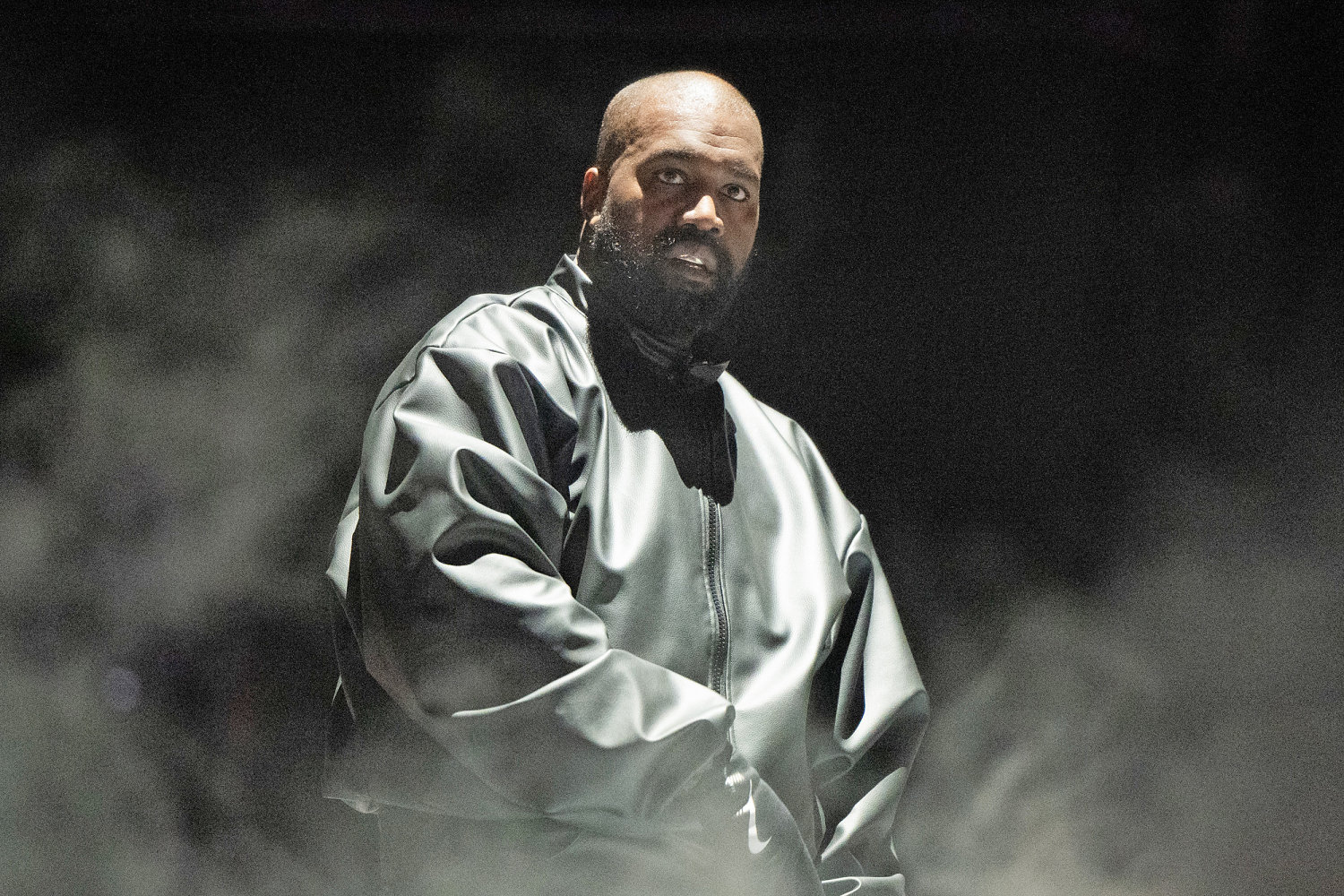

Minister for Pensions Torsten Bell said: “We’re ramping up the pace of pension reform, to ensure that people’s pension savings works as hard for them as they worked to save.

“The measures in our Pension Schemes Bill will drive costs down and returns up on workers’ retirement savings – putting more money in people’s pockets to the tune of up to £29,000 for an average earner and delivering on our Plan for Change.”

The plans are some of the biggest pension reforms in decades and the Treasury has previously described them as “radical”.

Millions to face ‘stealth tax’ on pensions

But the pensions boost comes as it was revealed millions of pensioners face being hit by a “stealth tax”.

The Mail on Sunday is reporting that everyone on the full state pension could be forced to pay income tax as early as next year, even if they have no other income.

It means millions of people who have no other way to fund their retirement will start paying tax for the first time.

This is because the personal allowance – the amount of income you can have before you start to pay tax – is stuck at £12,570 at least until 2028.

Meanwhile the state pension, which is currently at £11,973 a year, is on track to go over that limit due to the triple lock system.

Under the triple lock, the state pension increases by whichever is highest out of the rate of inflation, annual earnings growth or 2.5%.

If average earnings continue to grow at their current rate of 5.2%, next year’s state pension will rise above the income tax threshold for the first time.

Therefore pensioners relying entirely on the state pension will need to pay the basic tax rate of 20% on any amount above the personal allowance limit.

How does the state pension work?

AT the moment the current state pension is paid to both men and women from age 66 - but it's due to rise to 67 by 2028 and 68 by 2046.

The state pension is a recurring payment from the government most Brits start getting when they reach State Pension age.

But not everyone gets the same amount, and you are awarded depending on your National Insurance record.

For most pensioners, it forms only part of their retirement income, as they could have other pots from a workplace pension, earning and savings.

The new state pension is based on people’s National Insurance records.

Workers must have 35 qualifying years of National Insurance to get the maximum amount of the new state pension.

You earn National Insurance qualifying years through work, or by getting credits, for instance when you are looking after children and claiming child benefit.

If you have gaps, you can top up your record by paying in voluntary National Insurance contributions.

To get the old, full basic state pension, you will need 30 years of contributions or credits.

You will need at least 10 years on your NI record to get any state pension.

.jpeg?width=1200&auto=webp&trim=376,0,157,0#)